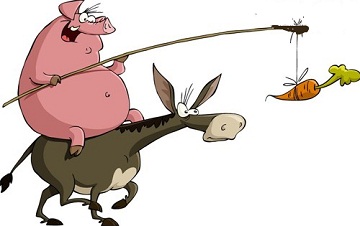

Regulating a for-profit sector funded with public money is really really hard. It requires the intricate placement of carrots and sticks within the system to drive the right behaviour. It is further complicated by the fact that these carrots and sticks will inevitably spawn unintended second order carrots and sticks. Rest assured, free market participants will always find a way to dodge the sticks and feast on the juiciest carrots.

It is fascinating to see this play out in the public domain as 3 sizeable players in the residential aged care sector (Estia, Regis and Japara) listed on the ASX in quick succession in response to the Living Longer Living Better reforms on 1st July 2014.

Following up on the largely theoretical piece I wrote back in May, I will now revisit the sector but this time armed with 2 years of financial data. (I would encourage those not familiar with the sector to read Leveraging up the Aged Care Sector first).

$1.5bn of new assets added since listing

We can see below that the combined asset bases of the trio have expanded by a very substantive c.$1.5bn since their respective listings:

The new assets on the trio’s balance sheets have largely been added via acquisitions rather than investments into new or existing facilities, by a factor of 2.5 to 1:

Total NPAT generated by the trio, however, have only increased by c.$42m (on a normalised basis) over the 2 years since their respective listings:

(I have not adjusted for part-year contribution from FY2016 acquisitions, however this should be somewhat offset by the fact that I have also not adjusted for part-year contributions from FY2014 acquisitions).

Acquisition Goodwill and Intangible Assets

So incremental NPAT was c.2.7% as a percentage of the incremental increase in assets.

Why is this so low? Well out of the roughly one billion dollar that have been spent on acquisitions, $392m was directly attributable to acquisition goodwill (excess valuation paid above net asset value).

This was on top of $267m of new intangible assets already attributable to “bed licences” (based on “fair value” assessment).

Given that the value of bed licenses have already been accounted for at fair value, how are the value of acquisition goodwill supported? Well they’re supported using discounted cashflow projections.

Interestingly, we can see that Estia’s cashflow projections (for the purpose of goodwill impairment testing) now includes future greenfield and brownfield developments:

In Estia’s FY2015 annual report:

In Estia’s FY2016 annual report:

So are goodwill valuations looking increasingly stretched? I have no idea, only the auditors would have the answer.

How are $1.5bn in new assets funded?

We can clearly see here that aged care residents have funded most of the incremental capital since IPO (to the tune of c.$800m), with bank debts making up the shortfall:

Note that only a tiny sliver of equity capital has been reinvested into the sector since the trio became listed entities. In fact if we include FY2016 dividends (not recognised on FY2016 balance sheets) there was actually a net outflow of equity capital from the trio.

This is not surprising given that the trio have, from the outset, targeted a 100% NPAT payout ratio (with Estia only recently reducing this to 90%). In other words, any profits generated as listed entities was never intended to be re-invested back into the sector.

How value is really created

Putting all the pieces together, we can deduce that value creation to-date have not come from the trio investing into the build-out of new facilities nor has it come from organic earnings growth reinvested and compounded.

It has come from financial arbitrage facilitated by the fact that $1.9bn of Refundable Accommodation Deposits on the trio’s respective balance sheets are not accounted for by the market as either equity or debt. The essence of the hustle can be summarised simply as follows:

(1) Buy incremental earnings using nil-cost, covenant-free capital from aged care residents (i.e. Refundable Accommodation Deposits)

(2) Each $1 dollar of incremental earnings is then valued by the stock market at $21 dollars of market valuation (i.e. listing P/E multiples of the trio)

Therefore, the $42m of incremental NPAT acquired using $1.5bn of new incremental capital is not viewed in context of generating a very poor 2.7% ROIC, but rather in context of “creating” c.$882m in incremental market capitalisation.

So the well intentioned and seemingly clever piece of legislation to give the private sector a carrot to build out the nation’s supply of aged care places has unintentionally spawned a much juicier carrot in the form of an equity capital markets arbitrage.

Note: The above blog post constitutes the author’s personal views only and is not to be construed as investment advice in any shape or form. Being obviously passionate about the art of investing, the author may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this blog post. Disclosure – I hold short positions in both EHE and JHC at the time of publishing this article.

Why would you short JHC and not REG when JHC is traded cheaper at close to replacement value? JHC can receive takeover offer while REG not likely.

Thanks Tim, I don’t like to discuss individual positions here, but happy to take it offline if you like.

Interesting analysis as usual findthemoat, thank you.